The Secret Of Info About How To Get Agi From Last Year

Go to www.irs.gov and request a.

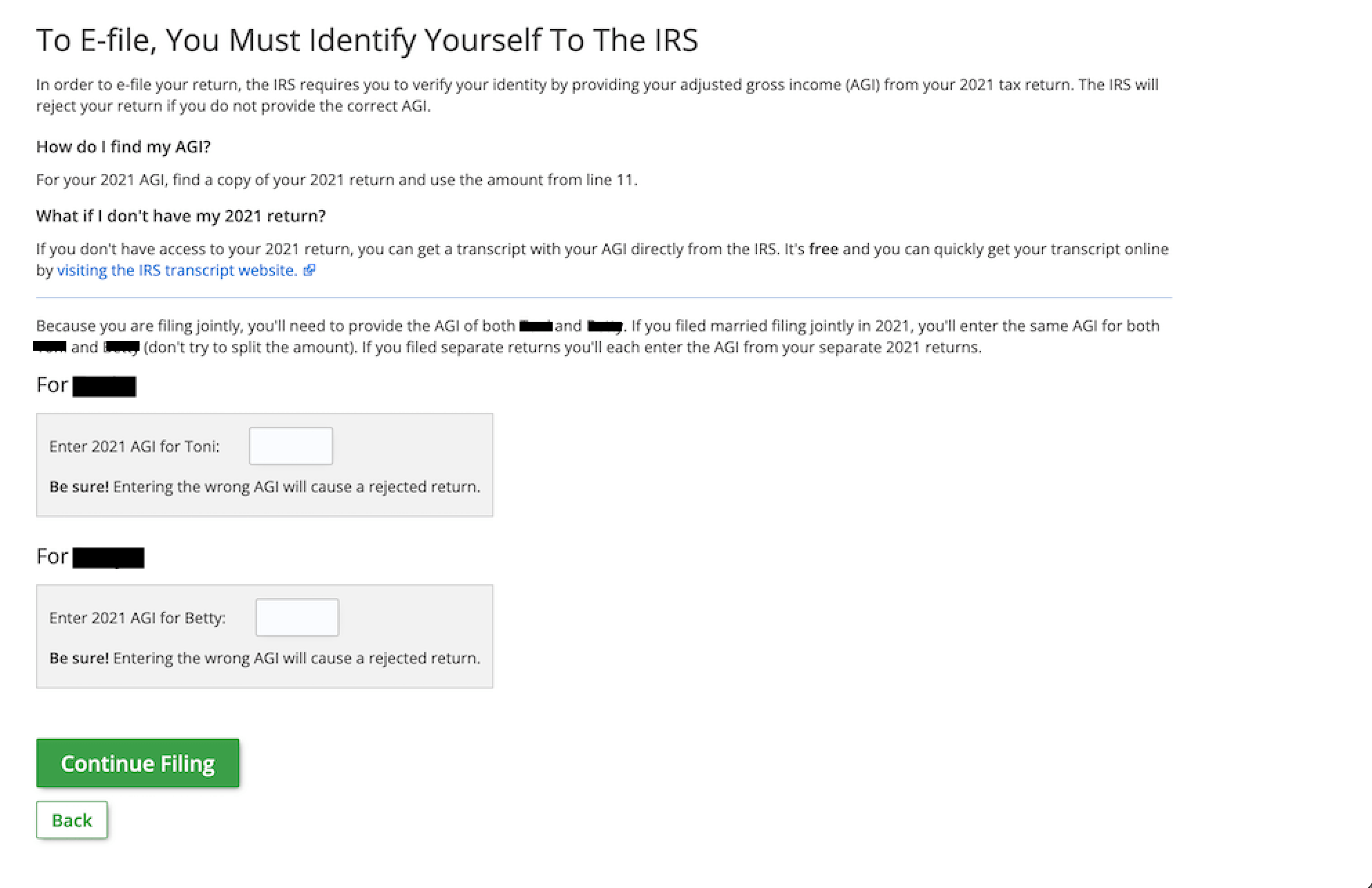

How to get agi from last year. How to locate your previous year agi if you don’t have access to your return. The irs secure access identity verification process must be completed. Taxpayers who are unable to register or prefer not to use get transcript online may use get transcript by mail to order a tax return or account transcript type.

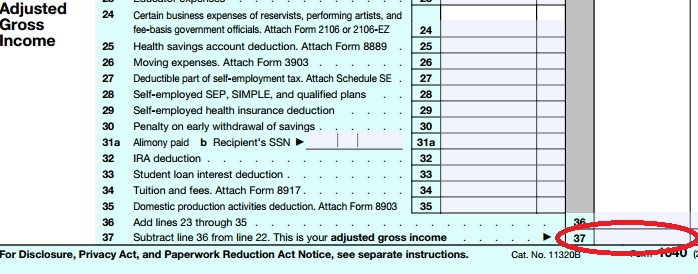

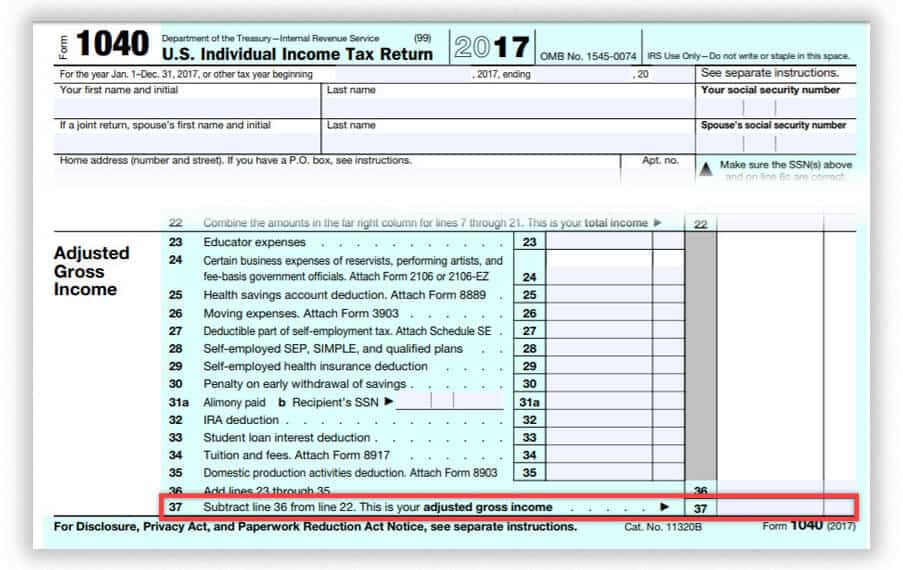

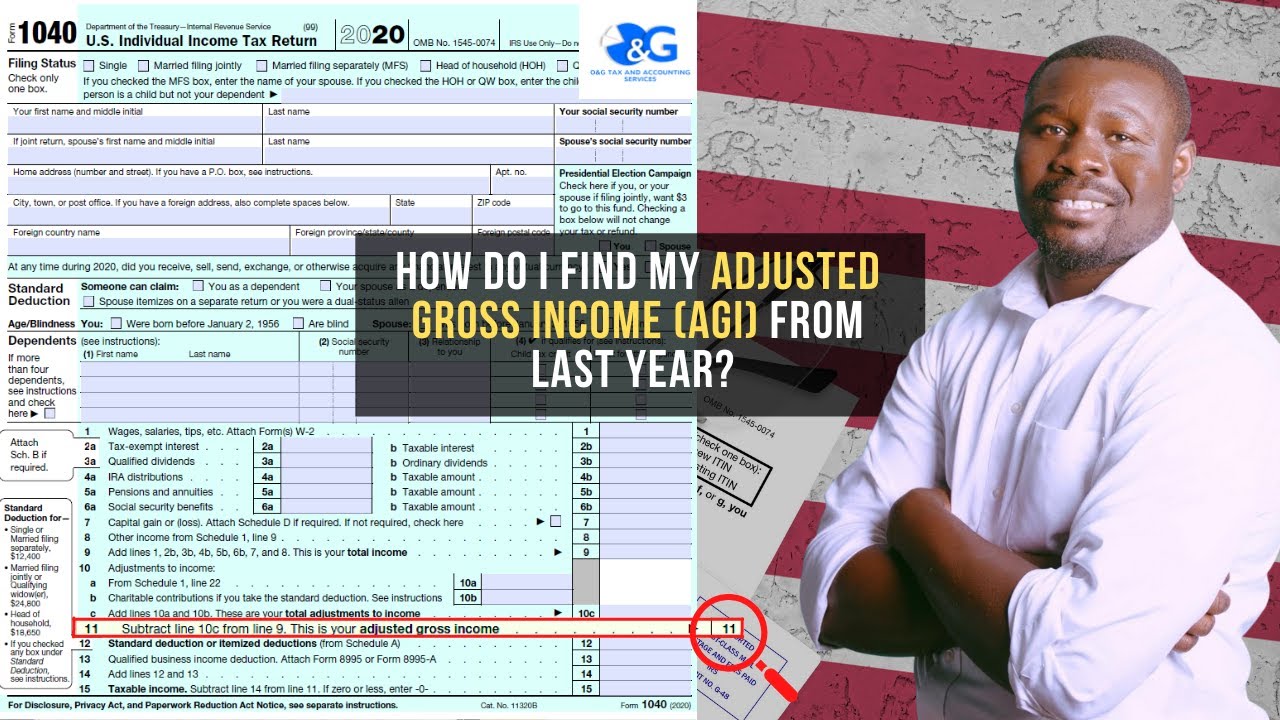

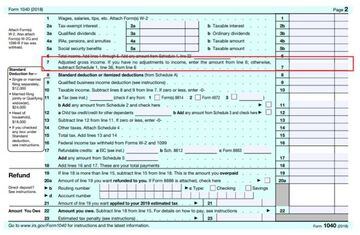

If you filed your 2019 taxes with turbotax, sign in and go down to your tax returns & documents. To see your prior year agi immediately, use the irs get transcript online tool. Use only the “adjusted gross income”.

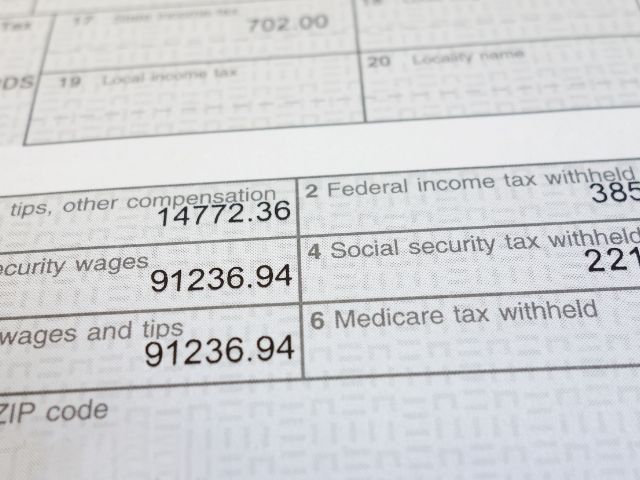

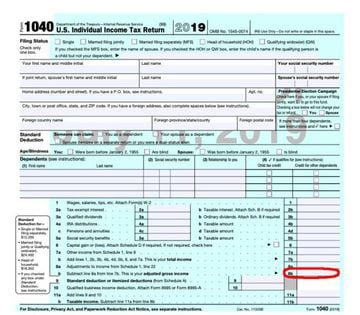

If you have your 1040 or 1040nr return you filed with the irs for 2020, look on line 11 for your agi. Use the irs’ get transcript online tool to immediately view your agi. Use your online account to immediately view your agi on the tax.

• your adjusted gross income (agi) consists of the total amount of income and. The irs keeps a record of your previous year’s tax returns. Use the irs get transcript online tool to immediately view your prior year agi.

To retrieve your original agi from your previous year's tax return you may do one of the following: If you don’t have your 2020 return, order a free digital transcript of your return. If you have your previous year's tax returns on record, you can find your.

There are a few places you can get your 2019 agi: I need my agi from last year. You must pass the secure access identity verification process.